|

Getting your Trinity Audio player ready...

|

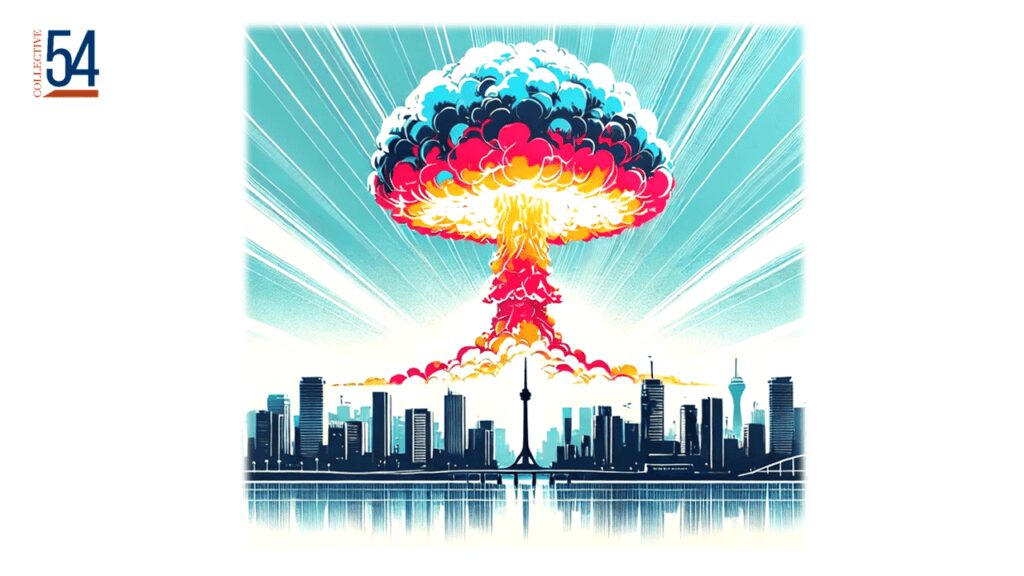

The Silent Killer of Small Service Firms: Protecting Your Business from Client Concentration Risk

For founders who run boutique professional service firms, the thrill of rapid growth and a big, lucrative client can be exhilarating. However, there’s a silent killer lurking in the shadows that often goes unnoticed until it’s too late – client concentration risk. In this blog post, we’ll define client concentration risk, explore why it poses a significant threat to small service firms, and discuss how to safeguard your business against this existential risk.

Understanding Client Concentration Risk

Client concentration risk is the vulnerability that arises when a significant portion of your revenue and success is dependent on a single or a few major clients. While it might seem like a blessing when that one big client is driving your growth, it can quickly turn into a curse if you become overly reliant on them.

Common Scenario: Rapid Growth and Hidden Risks

Client concentration risk is most often found in small service firms experiencing rapid growth. As the business skyrockets, it’s easy for founders to become blind to the potential dangers because the numbers (revenue, margin, and employee growth) look fantastic on the surface. However, this apparent success can hide the looming threat.

Operational Pitfalls of Client Concentration

Operating with heavy client concentration can lead to a series of costly mistakes, such as:

* Hiring Mistakes: The pressure to support the big client often results in rushed hiring decisions, leading to mismatches and inefficiencies in your team.

* Profit Dip: Offering volume discounts to retain the big client and reinvesting profits without a solid business case can erode your profitability over time.

* Toxic Culture: Rapid hiring can disrupt your company culture, as new employees are more focused on “getting the work done” than on the core values of your firm.

* Neglected Sales: Over-reliance on one big client can lead to a lack of focus on sales activities, leaving your business vulnerable if that client goes away.

The Wake-Up Call

All these operational challenges often go unnoticed during the “good times.” Founders may ignore the underlying threat until the day the big client decides to cancel. This sudden realization can be a devastating blow, exposing the illusion of success built solely on one client.

Three Actions to Protect Your Business

To safeguard your service firm from client concentration risk, consider taking these three actions:

- Diversify Your Client Portfolio: Actively seek out new clients to reduce dependency on any single source of revenue. Invest in marketing and sales efforts to cultivate a broader client base. For example, this should be done while the one big client is fat and happy and long before the cancelation notice arrives.

- Implement Risk Mitigation Strategies: Develop contingency plans in case you lose your major client. This might involve building up a financial cushion, cross-training employees, or identifying alternative revenue streams. For example, know exactly how you will implement a RIF (reduction in force) when the big client stops paying the bills.

- Maintain a Client-Focused Culture: Foster a culture that emphasizes the importance of all clients, big and small. Encourage your team to consistently provide exceptional service to each client to strengthen relationships and reduce churn. For example, today’s small clients are tomorrow’s big clients.

Conclusion

Client concentration risk is the silent killer of small service firms, but with awareness and proactive measures, you can protect your business from this existential threat. Don’t wait until the big client walks away to realize the dangers of client concentration. Instead, take action now to diversify your client base, implement risk mitigation strategies, and maintain a client-focused culture. Your business’s future success depends on it.

And for further insights, support, and a community of founders who understand the challenges you face, consider joining Collective 54 – a platform dedicated to helping boutique professional service firms thrive in an ever-changing landscape. Together, we can navigate the complexities of running a successful service firm and avoid the pitfalls of client concentration risk.