|

Getting your Trinity Audio player ready...

|

How Good Are You at Predicting the Future? Reflections on Attempting to Time the Market for your Exit

Introduction

The road to a successful exit is littered with the bodies of entrepreneurs that have attempted to time the market[1]. Lest you become another casualty, I wanted to give you some things to consider before you try your hand at predicting how future macroeconomic or sector-specific conditions are likely to unfold. Start by accepting that you are never going to know the perfect time to sell with 100% certainty.

A founder’s decision about when to take on an investment partner or consider a full sale via a strategic buyer is an important one. And, as a founder, it may be tempting to incorporate the expected future states of the broader economic, M&A and sector-specific environments as part of your decision matrix. However, these variables can unduly influence the ultimate yes / no equation because predictions about these arenas require the contemplation of a vast array of unknown information. In this way, forward looking, market-based perspectives can masquerade as helpful data disguising what is really unnecessary and uncertain complexity. As a rule of thumb, life-altering decisions are best made upon a solid foundation of what is known.

If you are considering an exit, or you have received an unsolicited offer, there are three main types of market timing considerations that founders often explore – Macroeconomic, Sector-Specific and Company-Specific. Indeed, all three can impact the valuation of your business, but it may simplify the exercise to apply Occam’s Razor[2] and focus primarily on Company-Specific factors. After all, your intimate familiarity with your business represents an asymmetric information advantage and gives you privileged access to KPIs that are (i) certain and (ii) most likely to reveal the company’s future growth prospects.

In the event that you are not yet convinced to focus on company-specific factors to inform exit timing, the following sections will explore each of your market timing options with an assessment of the merits of attempting to do so.

I. Macroeconomic Timing

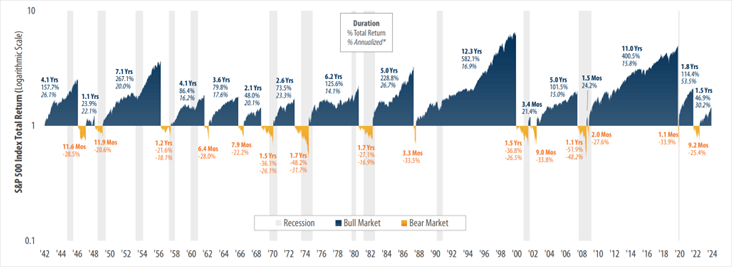

In this context, macroeconomic primarily refers to interest rates, growth and public company valuations. Despite the vast amount of data and predictive intelligence at our fingertips, we remain remarkably bad at predicting most macroeconomic moves. Note the irregularity in duration of each bear and bull market in the chart below. Bottom line, we don’t know when the next boom or bust is going to occur, nor how long they are going to last[3].

History of U.S. Bear & Bull Markets (1942-2023)

Source: First Trust Portfolios, LP

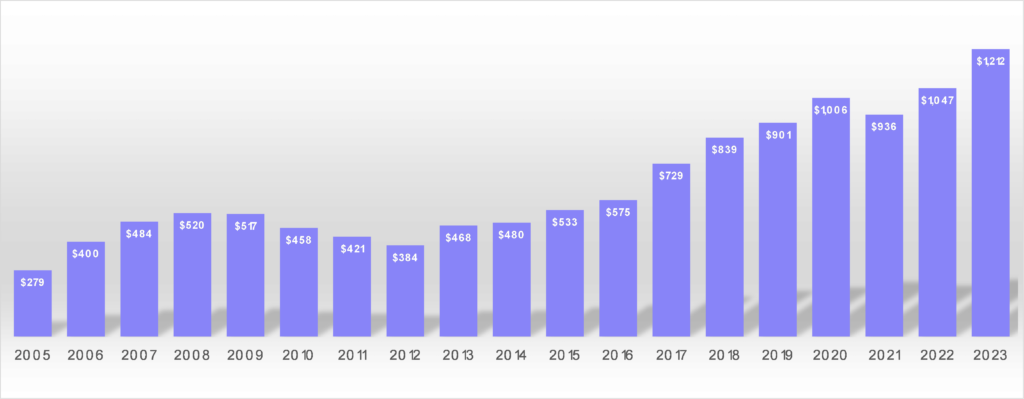

Moreover, valuations for private companies do not always correlate to their publicly-traded peers. A big contributor to this phenomenon is the concept of “dry powder”, which refers to capital that has been raised but not yet deployed[4]. As of the end of 2023, there was a record $1.2T (yes, trillion) in dry powder earmarked for investment into private equity transactions. This capital needs a home. This capital is attached to careers and families that depend on its timely deployment into favorable returns generating opportunities. This capital is a constant that exists irrespective of economic market conditions, and this phenomenon has often led me to describe the private market as a sub-economy unto itself. As a result, I caution many founders to disconnect their exit timing decisions from what they read about in the daily news.

Global Private Capital Dry Powder for Buyouts (2005-2023, $B)

Source: Prequin

There’s also what I call the “down market paradox” which means that a founder can actually generate a better exit outcome when the market is weaker if their company’s performance remains strong. During more challenging economic times, many founders delay their exit plans with the belief that better days will bring a better valuation. This indeed could be true. However, weak economies therefore result in fewer deals for buyers to evaluate which means that scaled services firms with great management teams, strong profitability and robust organic growth (i.e. “A” businesses) will receive outsized attention from prospective buyers for lack of other deals to evaluate. When there is less deal flow to go around, the scarcity of attractive investment opportunities can create a feeding frenzy amongst the buyer community when a great business comes to market.

Indeed, valuations for “A” businesses in 2023 not only held up, but many received far more offers than they might have in other environments. There were companies for which we submitted an offer during 2023 that received 40 or more competing offers from other interested parties. Imagine how favorable this dynamic is for founders. So, don’t always assume that down markets translate to low valuations.

II. Sector-Specific Timing

Like the economy, specific industry sectors experience cycles. Any given industry has its own set of growth drivers, regulatory forces, technological disruptions, demographic shifts and other factors that impact investor enthusiasm. To be sure, investment dollars follow good industry trends and, all things equal, valuations are better when sectors are expected to have a good run. After all, the majority of the price that an investor or buyer will be willing to pay for your business is based on its future growth prospects, and your sector’s health is a powerful contributor to that analysis.

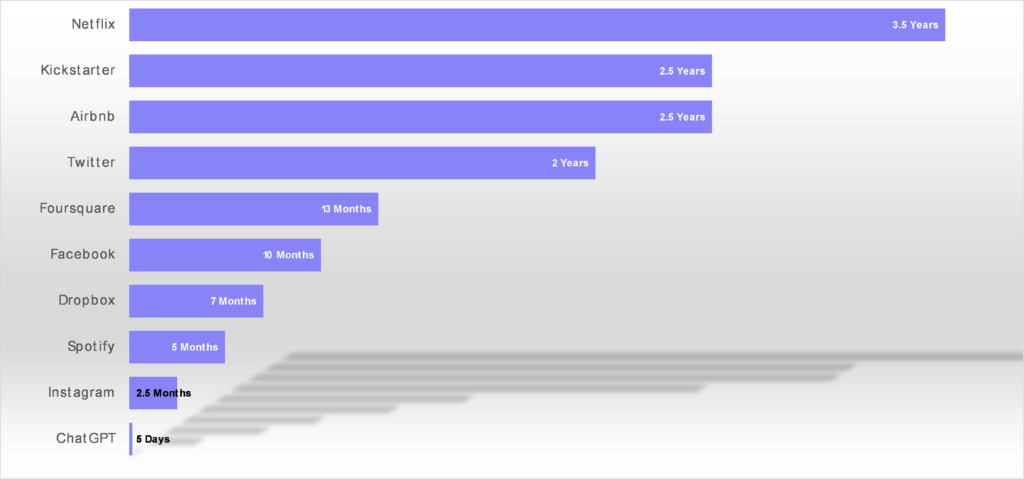

However, we are in an era of rapid technological change where today’s high margin services may be tomorrow’s AI-driven afterthought. This rate of innovation, and resulting disruption, makes the exercise of predicting what a given sector will look like even 12 months out extremely difficult. Case in point, take a look at the following chart which highlights the rapidly accelerating pace of adoption of select, household name technology platforms over the past 20 or so years. Can any of us really predict the future state of our sector amidst change like this?

Time For Selected Online Services to Reach 1M Users

Source: Business Insider

For me, sector-specific market timing, like its macroeconomic counterpart, represents another gamble based upon sub-optimal information, and you might do well to put this consideration in its proper place.

III. Company-Specific Timing

At last, we’ve departed the realm of the unknown and have returned home to what you know best…your business. And, nobody in the world understands the leading indicators and metrics portending its future performance better than you. For instance, you know things like the true probabilities associated with your sales pipeline, why you’re winning / losing business, what backlog is likely to be shifted out, who on your team might be loose in their seat and an array of other intangible (but no less important) signals that contribute to confidence or concern. Now, take a moment to compare the relative certainty of this company-specific information to your feelings about where you think the macroeconomy or your sector is headed. See the difference?

When it comes to exit timing, you are playing with cards that the buyer can’t see and may not ever see until after a deal is done. And, while there may be some temptation to exit when you anticipate challenges in the business, experience has shown us that the best outcomes occur when it’s a win / win for both sides and the new investor / owner continues to enjoy strong growth and profitability. This is especially true when founders are expected to rollover, or retain, a significant ownership percentage of the business because this will impact your relationship with your new partners as well as the future value of your equity. If you’re approaching an exit decision, a good thought experiment is whether you would invest in your business today.

So, finally, setting aside anything that’s related to the markets, if one or more things about your business is true, then you may want to seriously consider your timing for an exit or the unsolicited offer that came in lest your bird in the hand fly away:

-

- You’ve experienced multi-year growth in revenue and profits

- Bringing on a partner could help you scale faster or larger than you could on your own

- Proceeds from a transaction will allow you to “hit your number”

- The leading indicators of your company’s performance suggest that the near- to medium-term outlook is good

Conclusion

At the end of the day, only you can determine the best time to exit your business and should do so with whatever information and advice allows you to sleep well at night knowing that you are making a well-informed decision. As you weigh your options, just make sure to reflect on what is known and what isn’t – and if you ever want to talk about exit timing, shoot me an email.

About RLH Equity Partners

RLH is a private equity firm with over 40 years of experience investing in rapidly growing, founder-owned, knowledge-based B2B services firms. Our value creation strategy is defined by a heightened focus on culture, continuity of founder leadership, an emphasis on organic growth, and a conservative approach to the use of debt. In our long history, we’ve invested in and divested dozens of businesses and have made many decisions about the optimal time to sell the companies in which we are investors.

[1] Metaphorically speaking

[2]Attributed to the Franciscan friar, William of Occam, the notion that no more assumptions should be made than necessary

[3]One point of optimism that emerges from this chart is that the average length of time for a bear market is just under 12 months

[4]You may also hear people referring to “capital on the sidelines” which is synonymous to dry powder