Navigating the Complexity of the Net Working Capital

- Co-authored by Greg Fincke and Patrick Schmelzinger at Equiteq

In the world of mergers and acquisitions (M&A), there are multiple terms and process dynamics that come into play over the course of a transaction. One term that often stands out from the rest due to its complexity is net working capital. While it may seem like just another financial metric, the net working capital in the context of M&A transactions can have potential implications on the overall purchase price of a transaction. The purpose of this post is to provide founders with insight into net working capital, its role in a M&A transaction, and how to effectively prepare for the net working capital adjustment negotiation.

What is Net Working Capital?

Net working capital is definitionally defined as current assets minus current liabilities, but the metric takes a different form in an M&A transaction. Through the lens of a transaction, net working capital is often defined as current assets (excluding cash and cash equivalents) minus current liabilities (excluding short-term debt and debt-like items). The financial metric is utilized to assess the financial health of a business – it is a measure of the company’s ability to satisfy short-term liabilities and operational liquidity. Furthermore, an ideal position for a business is to have positive net working capital.

What is the Net Working Capital Purchase Price Adjustment?

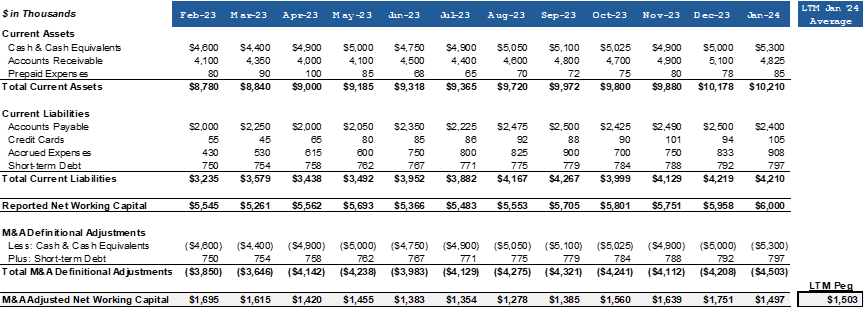

The net working capital purchase price adjustment is often an unfamiliar term to founders prior to embarking on an M&A transaction. When a buyer submits an LOI, the terms will often include that the purchase price assumes the business will be acquired with sufficient levels of net working capital. Said differently, the purchase price implicitly included the value of the company’s net working capital. Buyers include this term to protect against the potential situation where a seller liquidates their current assets from the business and delays satisfying their current liabilities until the transaction is complete – leaving the buyer with a less valuable business. As you may be wondering, how is a sufficient level of net working capital determined and what are the mechanics for the adjustment? During the due diligence phase, buyers dive deep into the components of net working capital, analyzing trends, assessing liquidity ratios, and evaluating historical net working capital cycles. Following their analyses, the buyer will propose what they view as the sufficient level of net working capital, often called the net working capital peg. There are multiple different methods used to calculate a net working capital peg, but a typical approach buyers will take is to present the peg as the average of the last twelve months (“LTM”) net working capital. Please see below an illustrative example of a LTM peg calculation:

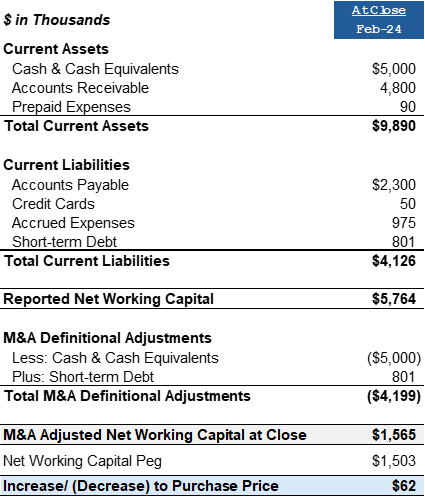

The net working capital peg is typically a focal point of negotiation as buyer and seller strive to reach a consensus that is a “win-win” for both parties as the adjustment isn’t traditionally thought of as a mechanism to increase or decrease value. The net working capital adjustment is the difference in the company’s net working capital as of the closing date of the transaction vs. the net working capital peg amount. For example, if the closing net working capital amount is higher (lower) than the net working capital peg, there would be an increase (decrease) to the purchase price. Please see below an illustrative example of how the net working capital adjustment works in practice:

How to Effectively Prepare for Net Working Capital Negotiations to Optimize Value

Rigorous, proactive preparation and strategic planning for net working capital negotiations is critical to ensure maximum negotiating leverage is achieved to arrive at the optimal net working capital peg. Prior to net working capital negotiations, sellers and/or their investment bankers should undergo detailed analyses to understand the historical trends of each balance account to: 1) identify any anomalies that skew historic net working capital trends, 2) understand the cycles of each account (i.e. is there seasonality?), and 3) have thorough analyses to underpin their view of the optimal net working capital peg. Being on the “front foot” with robust and accurate analyses to support your negotiation position and understanding how the buyer might counter enhance your negotiation strategy, mitigate risks, and maximize the potential for a desired outcome.

Conclusion

As founders begin on the M&A journey, understanding the nuances of net working capital and the adjustment becomes paramount. The adjustment underscores the importance of effective due diligence and preparation, sound advice from an investment banker regarding market standards, and tactical negotiation strategy. Mastering the art of successfully navigating the net working capital adjustment is crucial to preserve overall transaction consideration and ensure both parties view the result as a “win-win” ahead of creating a long-term partnership. If you would like to learn more about the net working capital adjustment or the M&A process, please feel free to contact me at greg.fincke@equiteq.com.